|

||||

|

Xin Cube Home > Articles > Xin Invoice 3.0 User Guide > Tax

|

||

|

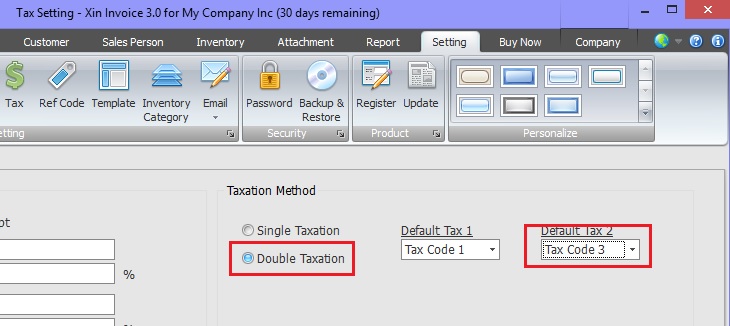

Getting Started Company Information Definition Add New Company Open Company Update Company Delete Company Add Company Logo Remove Company Logo Set System Data Default Document Setting Payment Terms Inventory Category Tax Reference Code Email Format Setup Email Server Personal Preference Inventory Database Definition Add new Inventory Update Inventory Delete Inventory Add Inventory Photo Remove Inventory Photo Import Inventory Export Inventory Customer Database Definition Add new Customer Update Customer Delete Customer Add Customer Photo Remove Customer Photo Import Customer Export Customer Sales Person Database Definition Add new Sales Person Update Sales Person Delete Sales Person Add Sales Person Photo Remove Sales Person Photo Add Sales Person Signature Remove Sales Person Signature Import Sales Person Export Sales Person Quotation Definition Draft Quotation Generate Quotation Update Quotation Delete Quotation Duplicate Quotation Customize Template Invoice Definition Draft Invoice Generate Invoice Update Invoice Delete Invoice Duplicate Invoice Import From Quotation Generate Delivery Note Receive Payment Recurring Invoice Customize Template Credit Note Definition Draft Credit Note Generate Credit Note Update Credit Note Delete Credit Note Duplicate Credit Note Import From Invoice Customize Template Security Set Password Data Backup |

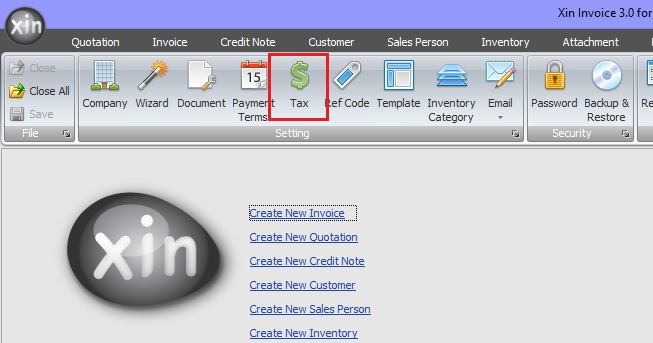

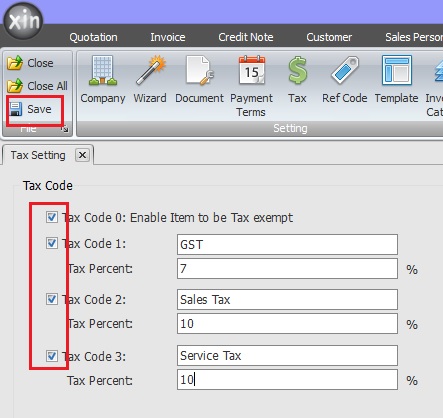

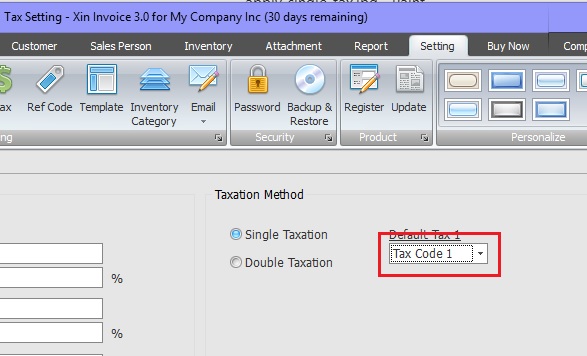

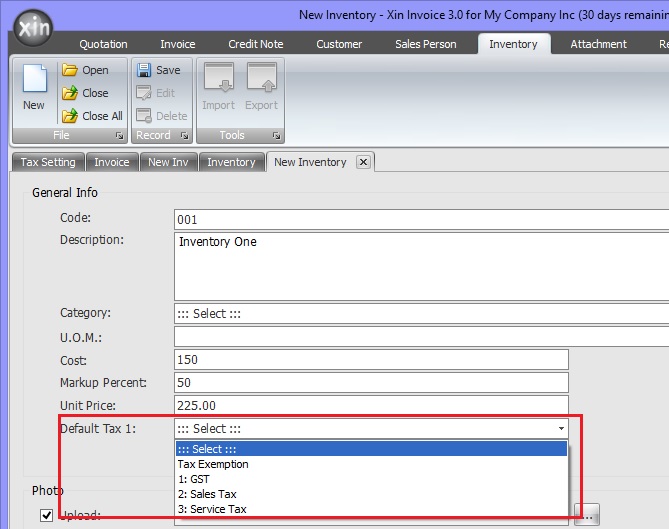

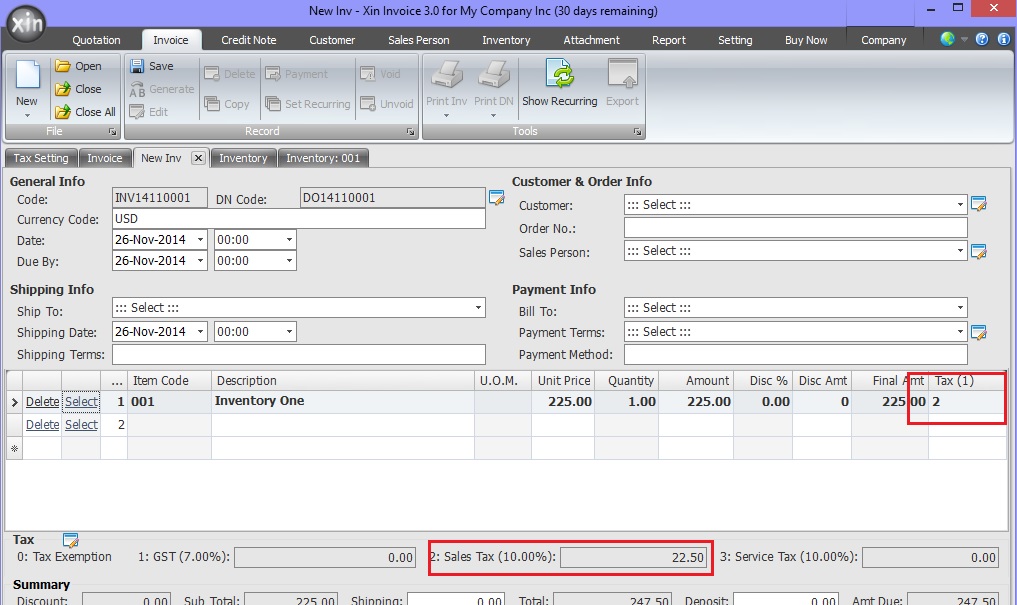

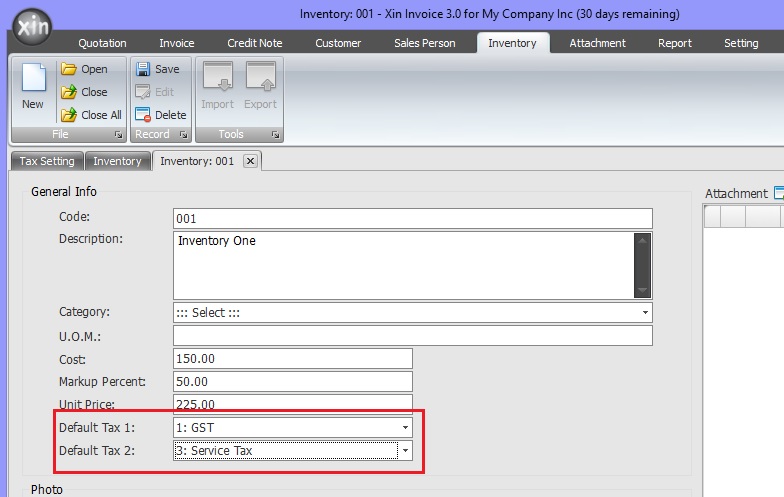

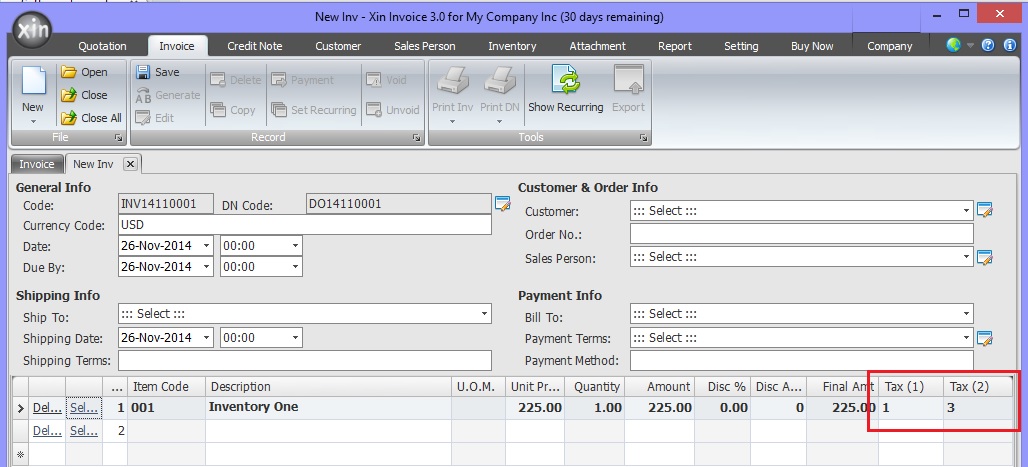

TaxYou may define your own Tax Code to be applied to each Inventory. Besides this, you may set the system either to have Single Taxation or Double Taxation. Single Taxation means when you create your Invoice, Quotation or Credit Note, you apply only 1 tax to an Inventory item, while for double taxation you can apply 2 tax to an Inventory item1. In Xin Invoice 3.0 program, click on "Setting" tab. On the top menu, click button "Tax".  2. Tax Code 0 = Tax exempt. Choose this option if some of your Inventory is tax exempted. 3. Select the option of how many tax code you need, if you need 3 tax code, select all 4 options. Enter your tax code and the tax percent applied to the Inventory item, then click on button "Save" on the top menu.  4. If GST is the most commonly Tax Code that applied to most of your Inventory items, you may set it as your default Tax Code. At the Taxation Method, choose "Tax Code 1" as Default Tax 1.  5. Now lets create an Inventory. Note that Tax Code 1 is auto selected as your default Tax Code. You can still set other Tax Code that applied to this Inventory if it is not Tax Code 1.  6. Next lets go to Invoice creation page. In the Invoice item list, select the Inventory that you"ve created just now. The Inventory detail will be auto populated to the Invoice item column, and the Tax Code will be auto selected. The summary of the tax amount is available at the bottom of the page.  7. Above sample shows how to set tax code for Single Taxation method. If you need to apply Double Taxation method, go to Tax page again.  8. Open Inventory detail, after setting the Double Taxation Method, now you can set 2 default tax code for an Inventory.  9. For each Inventory item in the Invoice, you may also apply 2 tax code.  Next : Click here to learn how to set Reference Code >> |

|

| Contact Us | For all Support issues, please use our online ticketing system. | Email Us | E-mail us anytime at

and we'll help. Please give us a few business days to respond! Thanks! |

Copyright © xincube 2009 ALL RIGHTS RESERVED. www.xincube.com